Seneca Signal: Weekly Performance - 02/20/26

Stats • February 19, 2026

Gains Amidst Crypto Freeze

Amidst the recent downturn in the digital asset market, we have entered a phase of "Asymmetric Correlation," where individual asset performance varies significantly. During this period of divergence, Nautilus’ combined strategies remained resilient.

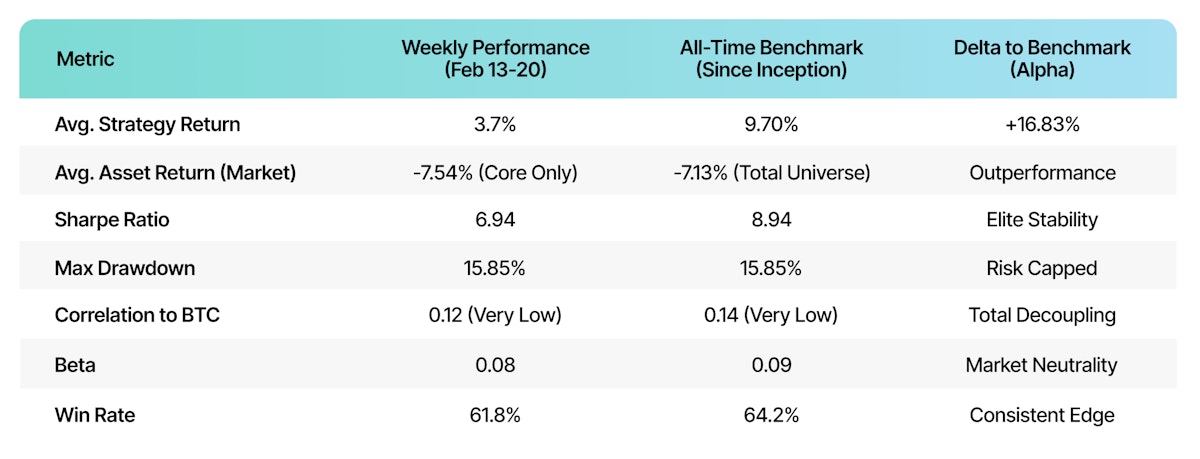

While the weekly return stood at 3.7%, the defining metric was the portfolio's exceptional Sharpe Ratio of 6.94. This high risk-adjusted return underscores the Seneca Engine’s ability to extract consistent alpha while effectively neutralizing the idiosyncratic volatility typically found in unmanaged crypto holdings.

Strategy Performance

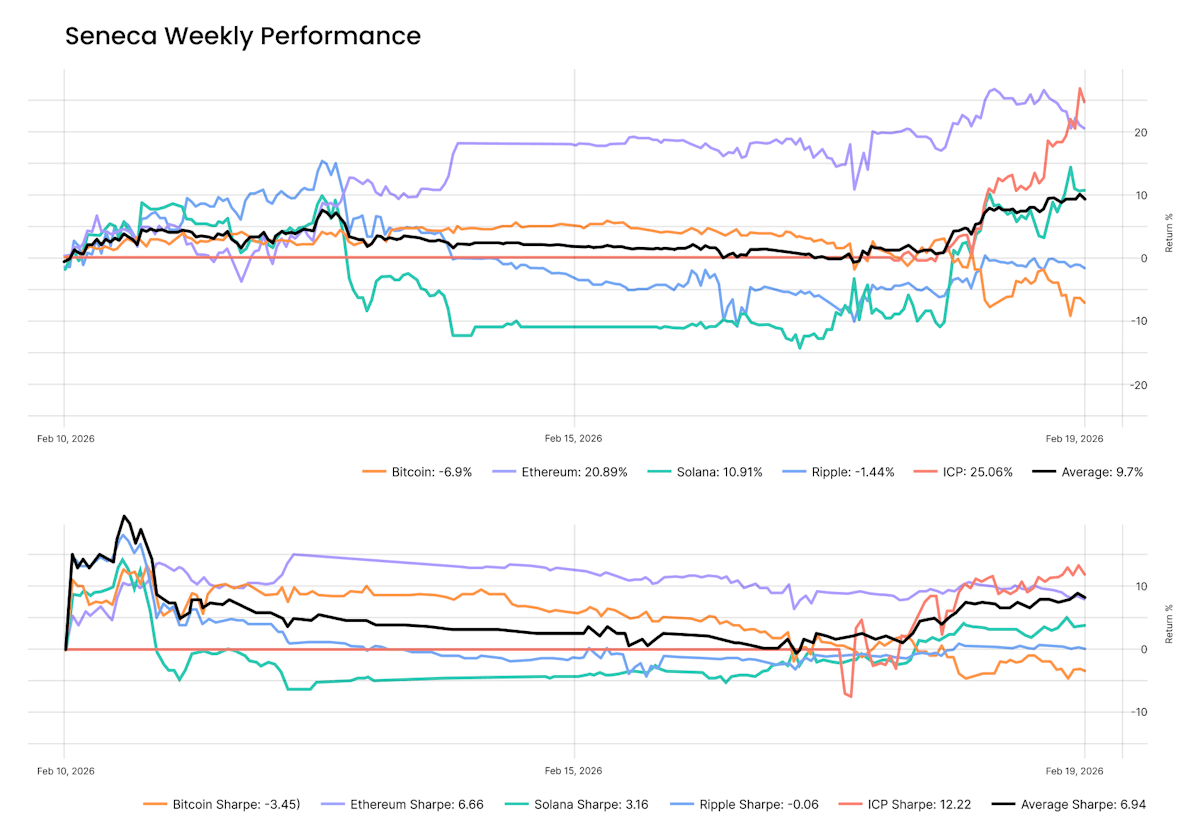

To better navigate this environment of high dispersion, Seneca has expanded its universe, integrating XRP and ICP into our core strategies. These newer additions are undergoing performance optimization, but they allow the trading engine to capture a broader range of 'high-beta' surges and 'laggard' rotations. This ongoing refinement ensures our self-hedging alpha remains resilient as liquidity shifts across the ecosystem.

Strategy Performance

This week’s market serves as a stark reminder that a passive "Buy & Hold" strategy is fundamentally ill-suited for the current drawdown. While holding may offer simplicity, it fails to navigate the extreme performance dispersion currently defining the space.

The reality of this environment is a sharp divide: high-beta assets are surging in isolated pockets, while stagnant laggards drag down the broader portfolio. In these conditions, static positioning essentially traps capital in underperforming assets, missing the rapid rotations required to capture meaningful gains.

The extreme gap between ICP (+23.06%) and XRP (-1.44%) proves that the market is no longer moving as a monolithic block. Our trading engine successfully navigated these movements using its 1–4x dynamic leverage strategy.

As shown in the graph below, the Average PnL (thick black line) maintained a steady upward trajectory. By weighting exposure, the engine dampened the impact of Ripple’s contraction while capturing the tailwinds of the ICP and ETH surges.

This week’s results reinforce a broader trend of institutional stability. Since inception, the Seneca Engine has delivered an elite 8.94 Sharpe Ratio, significantly outperforming the "Buy & Hold" volatility of BTC and ETH. By capping drawdowns at 15.85%, we continue to provide the capital preservation that unmanaged crypto holdings lack.

Risk Adjusted Returns

The strategy's 6.94 Sharpe Ratio mirrors our previous reporting, where Seneca significantly outperformed Bitcoin on a risk-adjusted basis during volatile periods.

Additionally, our primary chart illustrates a maximum drawdown of 15.85%. In a market where peak-to-trough volatility can often exceed 30–40% in unmanaged portfolios, this controlled drawdown stands as a testament to our automated risk frameworks.

The Sharpe Ratio graph (bottom panel) highlights that the fund’s risk-adjusted performance remains consistently higher and less volatile than the underlying assets themselves.

Near-term Outlook

Looking ahead, we expect Asymmetric Correlation to persist as the market increasingly prices in protocol-specific fundamentals. We anticipate continued divergence between high-beta assets and established benchmarks. The Seneca Engine will continue to calibrate its exposure, prioritizing high-conviction entries while maintaining the rigorous risk-management thresholds required to protect and grow investor capital.

Curious how the Seneca Engine maintains this level of performance across different market cycles? Read our latest deep-dive: Navigating the Noise: How Seneca Outperforms in Shifting Crypto Regimes.

Nautilus provides bespoke intelligence and liquidity solutions for fund managers, exchanges, and custodians. To explore our institutional suite and partnership opportunities, contact us at contact@nautilus.finance.

* Nautilus is a technology provider, not a legal custodian or investment advisor. Content is for informational purposes only and does not constitute financial advice. Past performance does not guarantee future results.